A Visual Regime Map for Institutional Posture Discussions

EngineerTrade.io provides an interpretive overlay that standardizes how investment teams describe equity regimes, tone, and phase progression. The Gemstone & Moon framework is non-predictive: it is built to support context, consistency, and governance clarity, not to generate trade instructions.

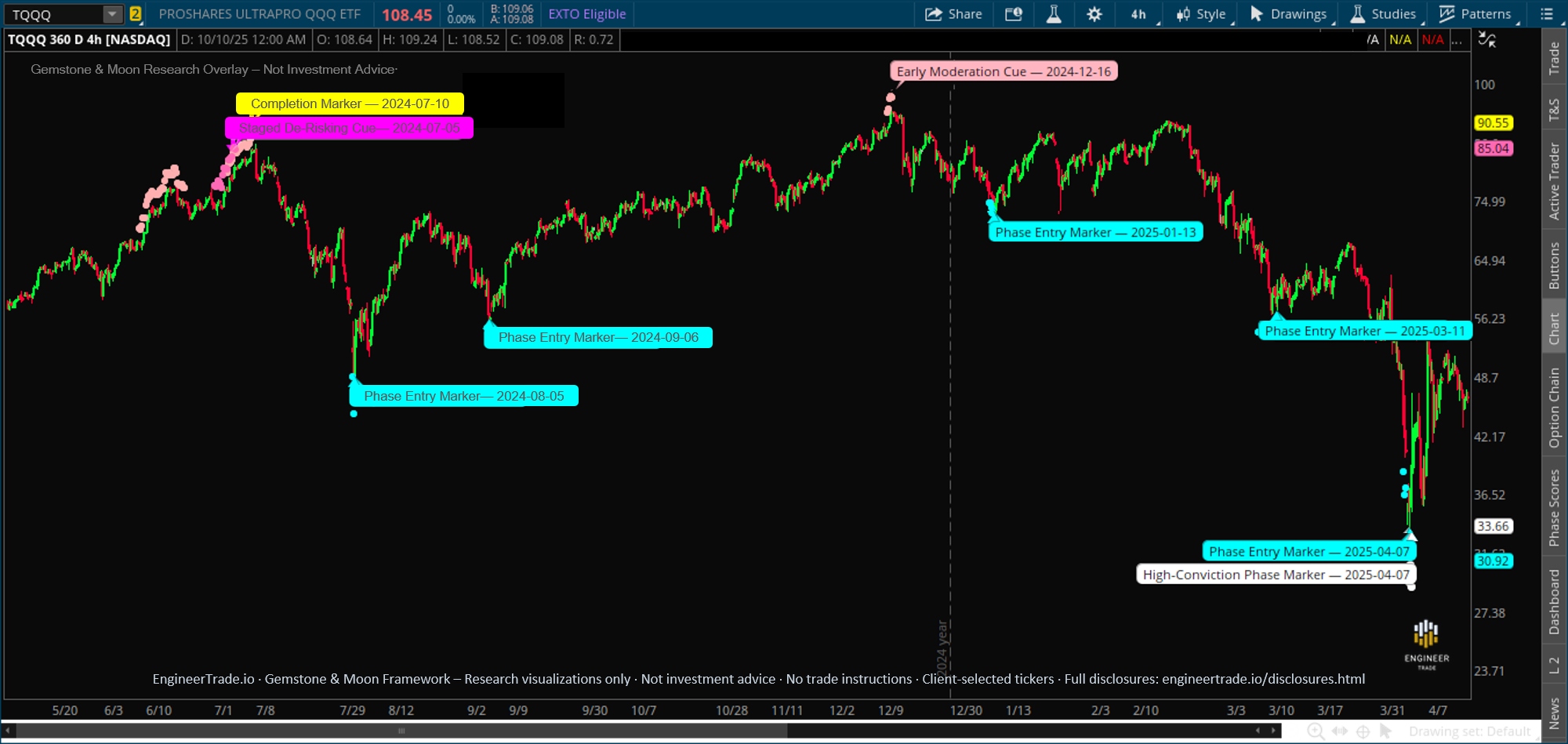

The overlay tracks how participation, momentum, and exhaustion behavior evolve through the cycle, classifying conditions into a small set of visual phases — from Entry-like to Exhaustion-like environments, including completion and reset. These visuals help CIOs, PMs, and risk teams align on “where we are in the cycle” during both accelerations and drawdowns.

- As a shared regime map for CIO, PM, risk, and research conversations.

- To support posture documentation and drawdown awareness in IC materials.

- To provide governance-ready artifacts for RIAs, family offices, and OSJs.

- To maintain continuity of interpretation across multi-quarter and multi-year cycles.

Research, Operations & Institutional Access

Enrique Iliscupidez

Founder & Quantitative Strategy Lead

Creator of the Gemstone & Moon framework. Leads methodology development, multi-factor observation, and ongoing regime-mapping research.

Stephanie Lao

Operations & Client Delivery

Oversees scheduling, documentation flow, and secure distribution of overlay materials for institutional desks, family offices, and RIA home offices.

James Gesmundo, CPA, MBA

Strategic Partner, Institutional Allocations

Connects the framework with allocators at RIAs, family offices, and OCIOs, drawing on 20+ years of NYC financial stakeholder engagement.

Full team background and founder origin story: About EngineerTrade.io.

TQQQ (Nasdaq-100 3×) 2024–2025 — De-Risking, Completion and Rebuild

The overlay was annotated on a near real-time basis as conditions evolved — not as a timing tool, but as a documentation layer for regime tone, participation behavior, and cycle transitions. Committees and CIO teams can review how posture context evolved through accelerations, stress, and recovery without relying on ex-post narratives.

The illustration above is hypothetical and for research demonstration only. It does not reflect actual trading, transaction costs, or market impact. Past or hypothetical behavior is not indicative of future results.

Where Institutional Teams Typically Start

1. Read the Framework

Most teams begin with the ungated institutional methodology overview. It explains the pillars, phase taxonomy, and governance orientation.

2. Request Overlay Access

For pilots and formal review, CIO or oversight teams can request overlay access for a defined set of names and see how the regime map fits into their existing process.

How Institutional Teams License the Overlay

Access is structured by scope of internal usage — from a single Investment Committee, to multi-PM platforms, to enterprise-wide internal visibility. All tiers include unlimited internal users and deliver descriptive, time-stamped overlay materials for posture documentation, governance reviews, and IC meeting materials.

Interpretive Framework, Not Advice

EngineerTrade.io provides analytical and educational research only. Materials are informational in nature, are not investment advice or a recommendation to buy or sell any security, and are intended for institutional and professional investors. The framework is descriptive and non-predictive. Execution and portfolio decisions remain solely with the investment firm or family office.